You are a Californian commuter trying to avoid the freeway gridlock, a Toronto school kid thinking of a zippy scooter, a London café racer fanatic, or an Australian surfer interested in a cruiser on the Gold Coast, or you have a cousin who owns a chopper which he rides to work, and then you get yours, the desire to get started with a motorcycle may well result as a freedom kick. However, very soon, it runs into a tough reality: how are you going to afford it?

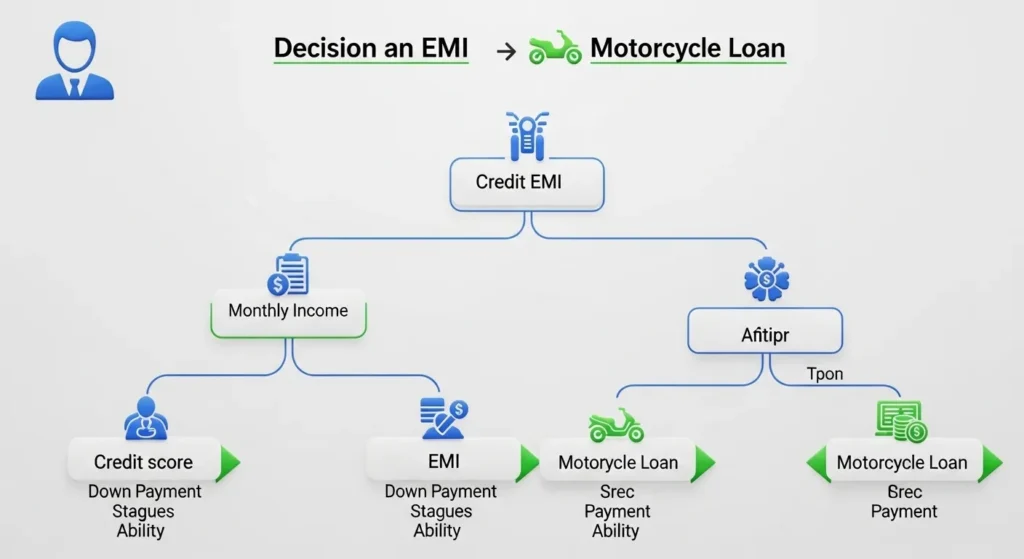

The two most common forms of financing are the motorcycle loans and the dealer-altered EMI (Equal Monthly Installments) plans globally. Even though they appear comparable, because they both do essentially the same thing, which is to pay monthly to cover a fixed duration, their mechanics, pricing and financial implications in the long run vary quite a bit depending on your location.

But these choices as you purchase your first bike are not only ones that hit your wallet hard they are the decisions that mould your credit history, your habit of monthly budgeting and also in some cases your case in obtaining any future large lending credits.

Financing a Motorcycle: Country-by-Country Basics

To get a bird-eye view of what financing looks like in the U.S., U.K., Canada, and Australia, let us start there.

| Country | Typical Bike Financing Options | Avg. Interest Rate (2025) | Credit Impact? |

|---|---|---|---|

| USA | Bank loans, dealership financing, credit unions | 6.5%–12% | Yes, reported to credit bureaus |

| UK | Personal loans, PCP, HP (Hire Purchase) | 4%–9% (with good credit) | Yes, affects credit rating |

| Canada | Dealer financing, bank loan, personal line of credit | 7%–10.5% | Yes, builds credit |

| Australia | Secured bike loans, dealer financing, leasing | 6.99%–14.5% | Yes, listed in credit file |

Source: NerdWallet US, CompareTheMarket UK, RateCity AU, Loans Canada

The Core Difference: EMI vs. Motorcycle Loan

The majority of the EMI deals are given by a dealership or indirect lenders; it is configured in the form of in-house installment plans with varying marketing jargon such as 0 percent APR or zero-down. These are indeed appealing especially to younger or first-time buyers but the pitfall is that the prices are overcharged, compulsory additions, and secret charges.

In comparison, motorcycle loan is a regulated product whether a bank, credit union, or fintech lender offers it. It is pegged to your credit score, income and repayment. It usually provides:

- Transparent interest rates

- Fixed repayment terms

- Early payoff flexibility

- Potential for lower insurance bundling

I am tempted to do the no-money-down dealer advert, but may end up paying extra out of the pocket in three years by $1,500, explains James C., an Oregon-based certified financial planner. In case you have good credit, then you will mostly get a better deal with the bank or credit union loan.

Real-Life Riders: Different Countries, Same Dilemma

🇺🇸 Brooklyn, NY – Marcus, 26 – IT Technician

Marcus desired Honda Rebel 500. The dealer company had a 0% APR 24 root. The catch however is? He was forced to purchase their 1,200 dollars of extended service package and to overpay insurance. Marcus chose instead a credit union loan of 6.9 per cent, no frills, and saved nearly 1,700 dollars on it in three years.

🇬🇧 Manchester, UK – Sophie, 31 – Freelance Photographer

Sophie took a Hire Purchase (HP) on a Royal Enfield Meteor. It made her the owner of it following final payment and enabled her to pay on a defined period of 36 months. It was more affordable per month to have done a Personal Contract Purchase (PCP) but this would have ended with her with nothing to show when she had finished the payments unless she paid a considerable balloon payment.

🇨🇦 Vancouver, BC – Jalen, 22 – University Student

Jalen could get a zero-down financing in his dealership in a used Yamaha MT-07 but at the cost of 11.5 percent interest. Instead, he opted to borrow a personal loan of $7,000 at 7.25 % in RBC. His payments per month reduced and the overall amount fell by nearly CAD 900.

🇦🇺 Melbourne, AUS – Kiara, 29 – Surf Instructor

Kiara also took a secured motorcycle loan because she wanted to purchase her dream cruiser through RateSetter. It has enabled her to use the bike as the collateral thus reducing her interest rate to 6.99%. Her credit rating rose in the six months and she was not a victim of aggressive dealer upselling.

Common Pitfalls in Motorcycle Financing

No matter where you live, avoid these frequent mistakes:

- Negligence of Total Cost of Ownership

- There are fuel, insurance, gear, registration–all this is not the whole story about monthly payments.

- Paying Concentrated Attention to the Monthly Payment

- The fewer EMI one pays per month, the longer the tenure and interest one pays.

- Not Getting a Pre-Approval with Your Bank or Lender

- Having the power to finance a dealership will put you in a position of negotiating leverage.

- Common Mistake is to not check Early Repayment Terms

- Many EMI contracts contain fines on premature closure which is laughably prevalent.

- The ideology that 0% APR is in fact free is very tempting.

- In many cases, they conceal that in the form of mark-ups, required warranties, or insurance bundling.

When Should You Choose EMI? And When Is a Loan Better?

Choose EMI If:

- You are new and you have no credit history.

- You are after a quick non-paperwork endorsement.

- You have an option to pay extra prices to get it immediately.

Choose a Loan If:

- Your credit is good (FICO of 670+ / Experian value of 700+ / Equifax AU value of > 600).

- You need obvious pricing, reduced overall cost and owner control.

- You appreciate accumulating long term credit and financial flexibility.

Motorcycle Financing Trends to Watch (2025 and Beyond)

- Buy Now, Pay Later (BNPL) is finding its way into the car industry, or in particular in the UK and Australia, with start-ups such as Klarna and Afterpay rolling out micro-leases and short-term partitions.

- In urban areas, subscription riding (such as Revel or ZippMobility) is also becoming an option, which gives one alternatives to ownership in the field.

- North America, particularly gig workers, are responding well to credit-building micro-loans which can be used to finance e-bikes and mopeds.

- Final Thoughts: Financing Your First Ride Without Regrets

When you get your first bike, that is not merely a buy assignment, but a statement. Not that you are ready to join the road, but that you are prepared on your own conditions.

However, the liberty of the ride must not turn into the load on money. Be it Austin or Adelaide (or Toronto, or Tyneside), think like a rider, plan like (CFO).

Plug the figures. Compare options. Ask some difficult questions.

What else could be better than the wind in your face, the wind in your face and the peace of mind that you have made the right financial decision before you have even turned the key.